Biometric Verification Now Mandatory for Cash Transactions

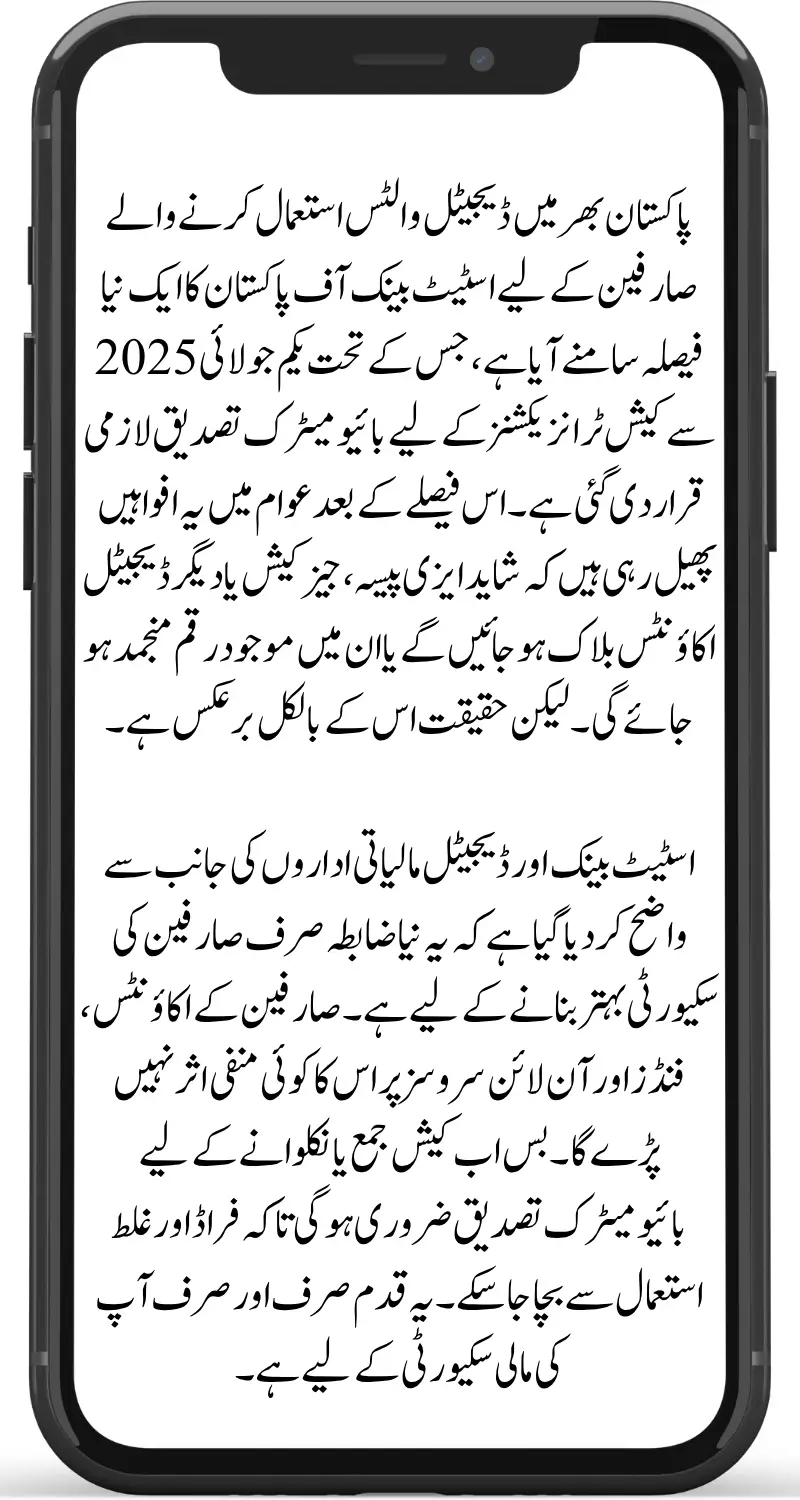

Starting July 1, 2025, the State Bank of Pakistan (SBP) has implemented a new regulation requiring biometric verification for all cash transactions made through digital wallet platforms like Easypaisa & JazzCash, and others. Biometric Verification Now Mandatory for Cash Transactions decision has raised widespread concern and confusion, with rumors circulating that digital wallets may be frozen or accounts could be blocked. Let’s uncover the truth and explain what this new rule really means for you.

Why Did the State Bank Introduce This Rule?

Over the past few years, Pakistan has seen rapid growth in mobile financial services and digital wallets. Platforms like Easypaisa and JazzCash have revolutionized access to financial services, especially for underserved populations. However, as usage increased, so did the risks of fraud, identity theft, and misuse.

To address these concerns and protect users, the SBP has made biometric verification mandatory for cash deposits and withdrawals done through retailers. The goal is to enhance security without limiting access to digital finance.

People Also Read: BISP Payment Increase 13500 to 14500 Confirmed for Eligible Families Check Full Details Now

Will Your Easypaisa or JazzCash Account Be Blocked?

Absolutely not. According to officials from SBP and representatives of major digital banks, this new rule will not freeze or block any existing accounts. There is no threat to your funds, and your online transactions will remain unaffected.

This rule only applies to physical cash transactions carried out at retailer shops. So, you can continue to send or receive money online, pay bills, or make purchases without any change.

What Will Change from July 1?

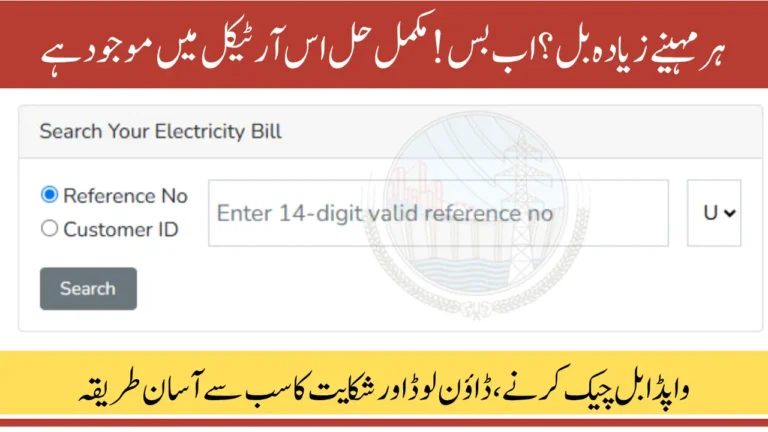

From now on, when you deposit or withdraw cash using a digital wallet at a retail agent, you’ll be required to undergo biometric verification on the spot. Here’s how it works:

- The agent will ask for your thumb impression.

- Only after successful biometric verification will the cash-in or cash-out transaction be processed.

- No cash deposits or withdrawals will be allowed without biometric verification.

People Also Read: BISP 8171 Payment Requirements Eligibility Updated Full Criteria and Documents You Need to Qualify Now

Why Is This Important for You?

This move is designed to protect your hard-earned money and ensure your transactions are safe from scams and identity misuse. It also helps prevent unauthorized transactions and makes sure that your account is being used only by you.

SBP clarified that these steps are part of a larger digital safety initiative, aimed at making Pakistan’s financial ecosystem more secure and trustworthy.

Conclusion: No Need to Worry – Just Be Aware

There’s no need to worry if you use Easypaisa, JazzCash, or any other digital wallet. Your money is safe, your account is active, and online transactions continue as usual. The only thing you need to do is verify your identity using biometrics when depositing or withdrawing cash at a retailer.

This is a positive step toward stronger digital security in Pakistan, and with proper awareness, all users can benefit from this protection without fear.

People Also Read: BISP WhatsApp Payment Complaint Full Guide 2025 to Register Issues and Get Fast Support

Key Takeaways in a Table

| Change | Effective From | Applies To | Not Affected |

|---|---|---|---|

| Biometric verification for cash deposits/withdrawals | July 1, 2025 | All digital wallet users (e.g., Easypaisa, JazzCash) | Online transfers, bill payments, account balances |

FAQs – Everything You Need to Know

Will my digital wallet account be frozen due to this new rule?

No. There is no freezing or blocking of accounts. The rule only applies to cash transactions at retail agents.

Do I need to verify biometrics for sending money online?

No. Online transactions are unaffected.

What if biometric verification fails?

You won’t be able to deposit or withdraw cash without successful biometric verification.

Is this rule permanent?

Yes, until further notice. It is part of SBP’s long-term security plan.